Authored by :

Michael G. Dow, CAIA, CFA, CPA, Chief Investment Officer

Julien R. Frazzo, Director of Risk Management and Securities Research

* * *

The Quick Facts

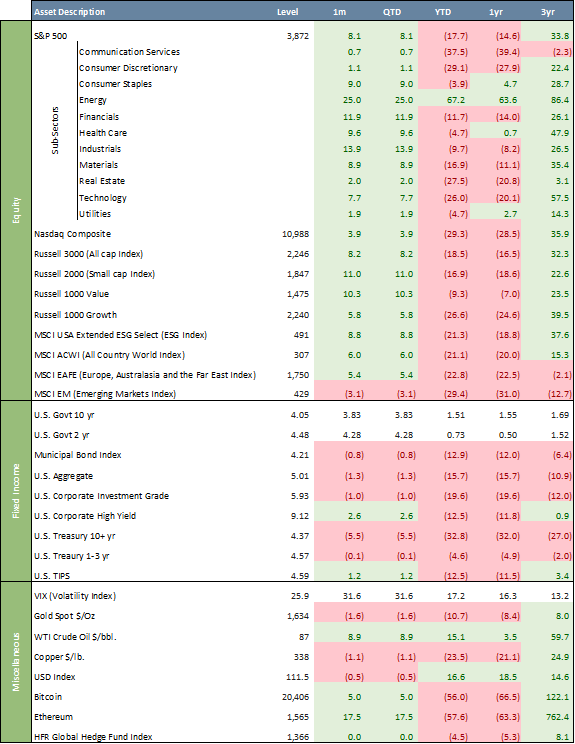

- Equity markets make a comeback in October, with the S&P 500 and Nasdaq gaining 8.1% and 3.9%, respectively

- Federal Reserve (Fed) hikes another 75bps for a fourth-straight time while signaling that its aggressive approach to curbing inflation may be approaching the final phase

- Yields on the benchmark 10-year Treasury note hit their highest level since 2008

- Bond volatility remained near record highs

- All eyes on the next CPI prints on November 10 and December 13

Markets made a comeback in October. The Dow led the gains, soaring 14.1% for the month. The 30-stock index finished its best month since 1976 as investors bet on more traditional companies to lead the next bull market. The S&P 500 and Nasdaq gained 8.1% and 3.9%, respectively.

October’s gains have come despite a mixed third-quarter earnings season, which has shown slowing growth and major disappointments from large tech companies. As we move past the halfway point of this earnings season, 71% of S&P 500 companies reported a positive earnings surprise, below the 5-year and 10-year averages of 77% and 73%, respectively, according to FactSet. Companies are reporting earnings 2.2% above consensus estimates, below the 5- and 10-year averages of 8.7% and 6.5%, respectively. Excluding the energy sector, earnings growth would be negative.

As we approach the end of the year, markets continue to be driven by rates, inflation, and a potential future recession. Recent data have dashed hopes for an immediate sharp drop in inflation while the labor market continues to look tight, albeit with some softening in demand. If disinflationary forces flow through economic data more clearly, a shift to smaller rate hikes and then a pause may not be too far off. Bond yields are in a peaking process, and that is a positive development for equities if that belief catches on.

The market appears to have taken some support from the idea that the Fed could soon begin to scale back on the pace of its tightening program. On November 2, the Fed raised rates by 75bps for a fourth-straight time while signaling that its aggressive approach to curbing inflation may be approaching the final phase. The rate increase had been widely expected. Fed Chair Jerome Powell opened a new phase in his campaign to regain control of inflation, saying U.S. interest rates will go higher than previously projected, but the path may soon involve smaller hikes. Addressing reporters, Powell said, “incoming data since our last meeting suggests that ultimate level of interest rates will be higher than previously expected… It is very premature to be thinking about pausing,” he added. The focus will now turn to inflation and unemployment data released before the next Federal Open Market Committee (FOMC) meeting on December 14. Futures markets are currently pricing in a 50bps hike in December, followed by another 25bps in January 2023.

On a total return basis, all 11 sectors finished the month higher, with Energy stocks by far the best performer, closing a staggering 25.0% up. Industrials and Financials gained double digits to start the fourth quarter, finishing the month higher by 13.9% and 11.9%, respectively. Consumer Discretionary and Communication Services were the laggards, posting a positive return of just 1.1% and 0.7%, respectively.

October also saw small caps rising sharply (+11.0% for the Russell 2000), while mega-caps lagged. The Russell 1000 Value was up 10.3% in October, outperforming the Russell 1000 Growth by 4.5% in October and 17.3% YTD. The outperformance of Value over Growth continues to be a major investment theme in an environment where long-dated cashflows get discounted at higher rates. The ESG segment of the market, as measured by the MSCI USA ESG Select Index, was up 8.8% in October, 0.7% more than the S&P 500. Over the last three years, the ESG index is up 37.6% and approximately 3.8% ahead of the S&P 500 on a total return basis.

Outside of the U.S., October also saw the fall of U.K. Prime Minster Liz Truss, as she was forced to step down following her cabinet’s ill-conceived plan to debt-fund tax cuts. The plan rocked financial markets, sending the British Pound to record lows and U.K. bond yields to post-financial crisis highs before the plan was pulled. Truss stayed in office for just 44 days. International equities did poorly compared to U.S. equities in October. The MSCI Emerging Markets Index posted a 3.1% loss in October, led by an historic Chinese market rout, and is now down 29.4% YTD. The MSCI EAFE (Europe, Australasia and the Far East) Index was up 5.4% in October, underperforming the U.S. Large Cap equity benchmark by 2.7%. After a period of underperformance earlier this year, U.S. equities, as measured by the S&P 500, are now outperforming both MSCI Emerging Markets and MSCI EAFE by 11.7% and 5.0%, respectively.

The yield on the benchmark U.S. 10-year Treasury now stands at 4.05%, a level last reached in 2008. Yield on the shorter-term 2-year Treasury recently touched 4.48%, which is the highest they have been since 2007. The yield curve inversion stabilized in October, with 2-year Treasury yielding 43bps more than 10-year maturities as of October 31. Treasury rates have seen a historic rise driven by inflation and a hawkish Fed.

Oil prices were up 8.9% in October. WTI Crude traded as high as $123.70/bbl back in March, a 14-year high, and YTD oil is up 15.1%. Gold declined by 1.6% in October and is now down 10.7% YTD, not acting as the inflation hedge Gold is expected to be. The U.S. Dollar Index was down 0.5% for the month but remains up 16.6% YTD. Cryptocurrencies were well-bid in October, with risk-taking for high beta assets making a comeback. Bitcoin and Ethereum were up 5.0% and 17.5%, respectively, in October. Bitcoin and Ethereum remain down 56.0% and 57.6% YTD, respectively.

Volatility in equity markets softened. The CBOE Volatility Index (or VIX), a popular measure of the stock market’s expectation of volatility based on S&P 500 index options, also known as the fear gauge, closed at 25.9 vs. an October month high at 33.6. While equity investors look to the VIX index as a measure of volatility, bond investors focus on the ICE BofA MOVE (MOVE) Index, which measures bond market volatility. The MOVE Index has more than doubled this year and remains near record highs.

Chart of the Month – Financial Conditions Index & Terminal Fed Funds

The Financial condition index captures market data – stock prices, stock market volatility, credit spreads, interest rates, and the trade-weighted exchange value of the U.S. Dollar. Tighter financial conditions correlate with lower economic activity in the future.

The Fed manages the economy based on a “financial conditions framework.” That is, by easing or tightening financial conditions, the Fed can achieve its desired macroeconomic outcomes. Currently, the central bank is explicitly tightening financial conditions to slow economic growth and fight inflation.

Financial conditions have tightened substantially year-to-date, with Fed rate hikes contributing to historic bond market declines and equity market volatility. The Fed needs to slow economic activity to reverse inflation. Doing so by throwing the economy into recession is not the goal, but a “soft-landing” is an increasingly difficult proposition. Near-term recession probabilities in the U.S. have risen materially. The Fed is getting what it wants by increasing equity market volatility, lowering stock prices and housing activity, and increasing the value of the U.S. Dollar.

Risk assets are not likely to stabilize until the Fed completes the rate hike cycle. Market expectations for the terminal Fed Funds rate have been constantly pushed higher by stubborn inflation readings. The market – and Beacon Pointe – expect the Fed to keep raising rates aggressively to preserve their inflation-fighting credibility. This process will continue until inflation is under control.

Quote of the Month

“An investment in knowledge pays the best interest.”

– Benjamin Franklin

Major Asset Class Dashboard

RELATED LINKS

Beacon ‘Pointe of View’ – A Market Update October 2022

Important Disclosure: This report is for informational purposes only. Opinions expressed herein are subject to change without notice. Beacon Pointe has exercised all reasonable professional care in preparing this information. The information has been obtained from sources we believe to be reliable; however, Beacon Pointe has not independently verified, or attested to, the accuracy or authenticity of the information. Nothing contained herein should be construed or relied upon as investment, legal or tax advice. All investments involve risks, including the loss of principal. Investors should consult with their financial professional before making any investment decisions. Past performance is not a guarantee of future results.

Copyright © 2024 Beacon Pointe Advisors, LLC®. No part of this document may be reproduced.