Authored by :

Michael G. Dow, CAIA, CFA, CPA, Chief Investment Officer

Julien R. Frazzo, Director of Risk Management and Securities Research

* * *

The Quick Facts

- U.S. equities soared to record highs in the first half of 2021

- Growth outperforms Value in Q2, after two consecutive quarters of underperformance

- The Federal Reserve (the “Fed”) signals rate hikes for 2023

- Interest rates and spreads experience meaningful reactions to the June Federal Open Market Committee (FOMC) meeting

- PCE Core price index, which excludes volatile food and energy prices, rises 3.4% from a year ago, the biggest increase since 1992

- G7 nations commit to a minimum corporate tax rate

U.S. equity benchmarks closed the first half of 2021 at or near record highs as the economy continues to reopen and more people are returning to work. Unprecedented fiscal and monetary stimulus has provided a consistent tailwind since 1Q 2020, and there is little evidence those efforts will be removed anytime soon.

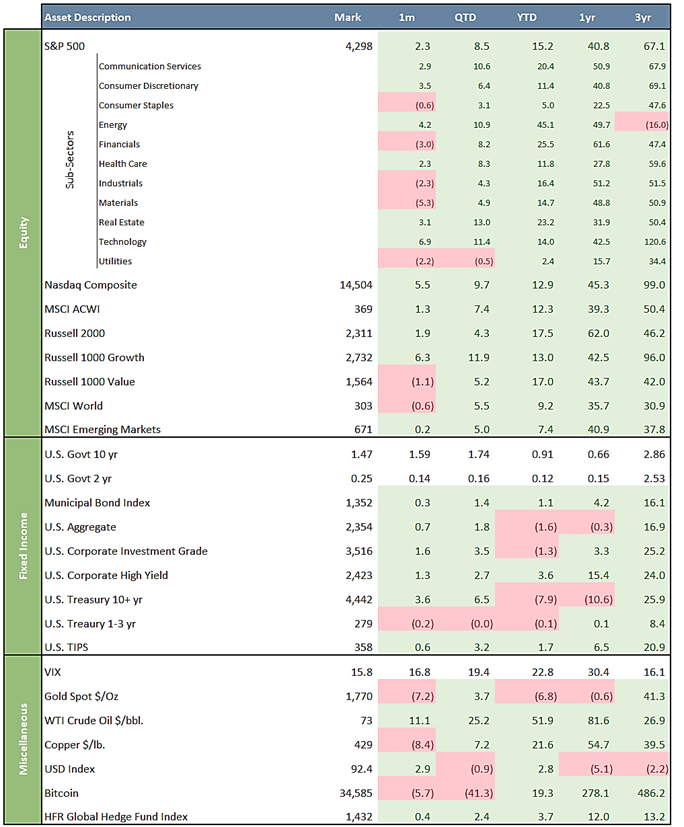

After a stumble in January, the S&P 500 has strung together five consecutive monthly gains and finished the first half of 2021 with a total return of 15.2%, including 2.3% in June. Smaller caps have outperformed, with the Russell 2000 returning 17.6% for 1H 2021. The Nasdaq was the top performer in both June and Q2 as a rotation has recently shifted back towards Growth over Value.

The Russell 1000 Value Index (+17% YTD) has outperformed the Russell 1000 Growth Index (+13% YTD) by 4% in 1H 2021. However, Value’s outperformance peaked in March and in recent weeks has reverted towards Growth due in large part to a more hawkish Fed at the June FOMC. Energy (+45.1% YTD), Financials (+25.5% YTD) and Real Estate (+23.2% YTD) were the top-performing sectors in 1H 2021. All three benefited from the “reopening” trade and follows 2020, in which they were the three worst-performing sectors.

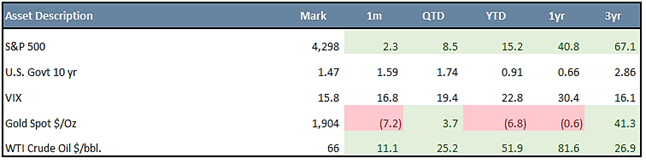

June Asset Class Performance

The June FOMC tapped the brakes on the reflation trade as the dot plot unveiled two unexpected rate hike projections in 2023, along with increased inflation and economic projections for 2021 and beyond. Chairman Powell attempted to dampen the committee’s hawkish forecasts by noting the recovery needs substantial future progress while stressing any future changes to the asset purchase program will be “orderly, methodical and transparent.” Fixed income responded accordingly, with the short end rising sharply and the long end falling. Following the June FOMC, the 30yr – 5yr U.S. Treasury (UST) spread declined a dramatic 27bps, wiping out all its gains since November 2020. The 30yr UST and 10yr UST yields each declined all three months in Q2 following four consecutive monthly gains.

WTI crude has finished higher over each of the last five quarters and ended 2Q with a YTD gain of 51.9%. Gold’s 7.2% drop-off in June can be attributed to talk of dialing back monetary accommodations by the Federal Reserve, with an eye toward eventually raising interest rates, which would weigh on non-yielding gold. Bitcoin traded as high as $63,410 in April but has declined significantly since. Trading at a 5-month low, Bitcoin has fallen another 5.7% in June to $34,585.

Volatility subsided by month’s end. The CBOE Volatility Index (or VIX), also known as the fear-gauge, spiked mid-month to above 20% around the FOMC meeting, before settling at 15.8%, the low of the month.

Leaders from the G7 countries agreed to back a new global minimum tax rate of at least 15% that companies would have to pay. By supporting the move, major economies are aiming to discourage multinationals from shifting profits – and tax revenues – to low-tax countries regardless of where their sales are made. Treasury Secretary Yellen said that getting other countries to go along with a base tax rate on overseas profits would minimize any disadvantage to American companies and make them less likely to move their operations to countries with lower taxes.

Investment Summary – “Rates and Rotation” in an Era of Financial Repression

Overall interest rates will be repressed, and inflation allowed to run somewhat higher than the Fed’s “2% average over time” target. Inflation worries are likely to contribute to market volatility, but it will take a lot more to shift the Federal Reserve towards a more rapid withdrawal of easy money. In the near term, market discounting of higher rates may lead to a rotation from Large Cap Growth to Large Cap Value, Small Cap, and international stocks. Alternative investments are favored over “safe yields” in a world of negative real interest rates.

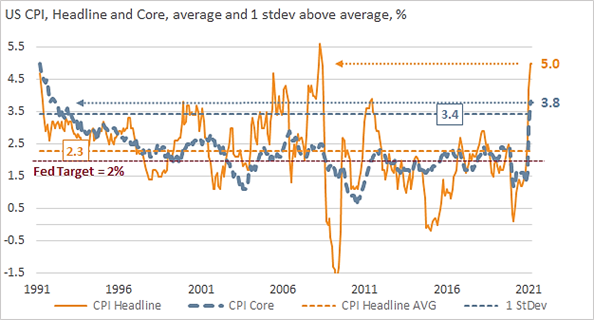

Chart of the Month – Highest Inflation Since August 2008

The U.S. CPI rose 0.6% m/m in May, with the core (e.g., food and energy) up 0.7%. The headline was 5% y/y with the 3.8% core inflation rate increase, the fastest pace since August 2008 and higher than Wall Street expectations. The 3.8% rise in the core inflation rate, which excludes food and energy prices, was the sharpest increase in nearly three decades.

Major Asset Class Dashboard

Important Disclosure: This report is for informational purposes only. Opinions expressed herein are subject to change without notice. Beacon Pointe has exercised all reasonable professional care in preparing this information. The information has been obtained from sources we believe to be reliable; however, Beacon Pointe has not independently verified, or attested to, the accuracy or authenticity of the information. Nothing contained herein should be construed or relied upon as investment, legal or tax advice. All investments involve risks, including the loss of principal. An investor should consult with their financial professional before making any investment decisions. Past performance is not a guarantee of future results.

Copyright © 2024 Beacon Pointe Advisors, LLC®. No part of this document may be reproduced.